Are you someone who wants to study in Canada? The dream of pursuing an overseas education is very fascinating. Many of you want a life portrayed in the web series, i.e., on-screen. Some want to enter the college with huge buildings, while others are eager to use the lab equipment. However, the dreams are in the sky but the finances are in the ground. i.e., the budget is short. If you are an aspirant who is short on finances, then this blog is for you. Here, you will get the details about the study loan for Canada. The various sections will answer the questions that will cross your mind.

Table of Contents

Loans are financial borrowings to cover expenses. Similarly, study loans are the monetary help that students usually take to afford their higher studies in another nation. These help them cover the travel fare, lodging, tuition fees, and daily expenses of staying in the country.

Did you know that you can get your loan without submitting any collateral? In the next section, you will learn about the types of study loans that are granted to pursue higher education in Canada.

There are two kinds of study loans:

Study Loan for Canada With Security: It is also called a collateral loan. It is the kind of loan that requires some kind of security document. It can be tangible assets like the house, the flat, and jewellery. Also, it can be intangible assets like insurance and fixed deposits. Usually, the loan amount is nearly equal to the amount of collateral submitted. The public banks of India generally lend secured education loan for Canada. Moreover, the amount of your loan will depend upon the collateral value. This means that the higher the collateral value, the higher the loan amount will be.

Study Loan for Canada Without Security: It is the second type of loan that is available to secure in order to study abroad in Canada. In simple words, it is called a non-collateral loan, i.e., the applicants are not required to submit any kind of security. However, there must be a co-applicant so that the loan probability (amount and tenure) can be determined by his/her income. If you are planning to take a study loan for Canada in India, then do not forget that only a few lenders grant unsecured funds. It can be a NBFC (Non-Banking Financial Corporation) or an international money lender. Also, private banks like ICICI Bank and Axis Bank provide non-collateral loans.

Additionally, note that if the amount exceeds INR 7.5 lakhs, then tangible assets will be submitted as collateral. Moreover, the guardians must be the co-borrowers of this kind of education loan.

There are many things that you must keep in mind while applying for an education loan in Canada. The list is as follows:

The above-mentioned criteria must be checked before applying for a loan in a lending institute. The interest rate and processing rate differ from bank to bank. Each institute covers varied expenses. Also, the time an institute takes differs with every scheme. Moreover, the repayment and prepayment options vary; some lenders allow prepayment while others do not. So, the applicant must know all the terms and conditions to avoid any financial mishap.

Knowing the interest rate is very important. It will affect your EMI amount directly. Here is a list of some banks along with the interest rate.

| Bank Name | Interest Offered |

| HDFC Bank | 9.55% p.a. |

| SBI Bank | 8.55% p.a. |

| Union Bank of India | 9.30% p.a. |

| Axis Bank | 13.70% p.a. |

In the next section, you will learn about the expenses that will be covered in the loan amount that will be sanctioned.

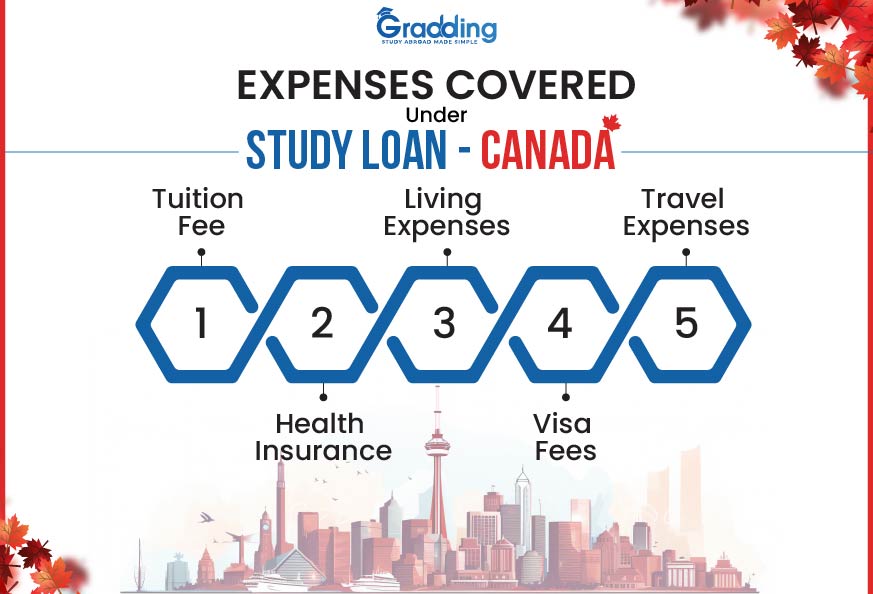

Before applying for a study loan for Canada, you should always check the list of expenses that are covered by the lender. You will come across many choices, but you have to opt for them wisely. Every scheme covers different expenses, and choosing a scheme that aligns with your financial goal will be a wise move. Get a gist of the covered expenses from the image below.

It is the amount charged by the educational institute for providing their services such as teaching, laboratories and libraries. It is one of the biggest private sources of revenue in a country. The money lenders usually cover the tuition fees in the loans they provide. The major amount of the loan is spent on the tuition fees. The approximate fees to study in Canada is briefly given below.UG Courses Fees (INR)6,46,000 - 16,15,000PG Courses Fees (INR)9,54,000MBA (INR)8,80,400 - 29,35,000PhD (INR)5,23,300 - 11,2140

| UG Courses Fees (INR) | 6,46,000 - 16,15,000 |

| PG Courses Fees (INR) | 9,54,000 |

| MBA (INR) | 8,80,400 - 29,35,000 |

| PhD (INR) | 5,23,300 - 11,2140 |

Alongside the tuition fees, living expenses are also one of the major expenses of studying abroad in Canada. Usually, the accommodation, food, and transport costs are covered in the living expenses. However, it is different for every scheme and money lending institute. Also, few lenders limit the living expenses as per the amount granted. It is advisable to discuss the living expenses with the lender.

Canada will not allow students to enter the border without health insurance. The rate of health insurance is usually very high, so it is also covered under the loan amount that is credited for your foreign studies. Although many lending institutes do not cover this expense, so you need to check the terms and conditions along with the details before applying for it.

There is a slightest chance that your lending institute may cover your visa fees. You have to pay this fee if not covered by the lender. Only a few private lenders cover this.

It is itself an expensive process that can cost a few lakhs. Although banks do not provide airfare by themselves, the applicant has to request it. By adding this charge to your loan, you can keep your savings intact. It can be further used in case of emergency.

While you study, you may incur expenses other than tuition fees, such as entrance fees, application fees, books, stationery, study tours, and equipment. Since these expenses are not included in the tuition fee, many financial institutes consider them when granting the loan amount.

| College Application Fees (INR) | 7674 |

| Entrance Fees (INR) | 14,000 |

| Visa Fees | 9,208 |

Also Read: Cost of Living in Canada

Securing an educational loan is a tedious and lengthy process. Also, it is time-consuming. One must know the process along with the important documents that are required to secure a Canada education loan as per their financial goal. Gradding.com has combined the process and document in this section. Have a look below.

Many students do not have proper knowledge about the process of getting a loan to go to Canada. In this case, they can get help from our experts to ease this step. Apart from this, scholars should understand the requirements of a study loan for Canada to avoid last minute rush. It can be valuable for learners to get admission to the desired university without money problems. To know the process of availing the loan, read the below pointers.

Step 1: First, students should acquire an acceptance letter from the Canadian University.

Step 2: Students should research the banks and make a list of all by checking their eligibility and required documents.

Step 3: After that, scholars can filter and compare to choose the suitable banks for getting the best student loan Canada interest rate.

Step 4: Students should prepare a list of expenses for the program, including daily living, cost of living, and other outlays to finalize the loan amount.

Step 5: Apart from the mentioned points, students can fill out the application form with proof of the required loan amount.

Following the above-mentioned five steps can be valuable for scholars to avail of a disbursement letter for an education loan. Students should also not wait until the last minute, as this process is time-consuming. Also, they can choose a finance provider that offers a faster processing period than others. There are several lenders that offer educational loans. Thus, students should compare the different loan providers.

Also Read: How to get Education Loans?

In this section, you will learn the list of documents required to bag a loan for students in Canada. Refer to the list below:

These are the documents that are necessary to show. The other documents can also be presented if applicable. The list is given below:

Also, the document requirements for each scheme and lending institute are different. So, you must communicate with the lender to know the exact need for your loan.

To secure a study loan for international students in Canada, you must have the following documents.

There are various lenders including the banks that offer loans for Canada-going aspirants. It can be valuable for scholars to know about them to avail of grants. Students can learn about providers from the mentioned pointers.

SBI offers an ed-vantage study loan for Canada and other overseas destinations. It can be valuable for scholars to take loans from the State Bank of India because they provide interest rates as low as 8.55%. Students can cover up to 90% of the entire amount of all expenses, including tuition and cost of living overlay. Apart from this, SBI offers loans of up to 1.5 crore to scholars.

HDFC Bank offers 100% amount of the academic expenses as student loans for Canada. It can be fruitful for scholars to avail of loans because they have a lower turn-back time. HDFC Bank also offers flexible repayment options to ease the journey for scholars. However, this bank provides loans of up to 36 lakhs.

ICICI Bank offers student loans for Canada to pursue higher education. Also, they provide a platform that includes various expenses to ease the journey of scholars. It can be valuable for learners to take loans from ICICI to purchase GIC. In addition, students can also get help for in-flight expenses, travel cards and forex services. Apart from this, scholars can avail of education loans for Canada of up to 1 crore.

These are the top education loan providers that can help students turn their dreams into reality. It can be valuable for scholars to take loans from the above-mentioned banks. Taking a loan from NBFCs can be slightly expensive as their interest rates are higher. So, it can be valuable for scholars to choose the suitable options that work for them.

If you are still confused and have not made a decision, then taking help from Gradding.com can be valuable. Getting assistance from us can be beneficial to avoid the problems.

The applicant must understand that taking and using the loan is not the only process they must follow. Repayment of the loan is crucial as well as a tough task. Do you know that your loan can be interest-free? Yes, there are options to repay your loan without paying the interest rate. Some lending institutes give the chance to make the payment during the course duration or within 6 months after the course is completed. Also, the loan repayment starts as soon as the scholar bags a job in the desired field. Moreover, you can repay it for up to 20 years. For all the repayment details, you must go through the terms and conditions mentioned in the agreement.

The process of thinking about the loan to repaying is a very lengthy task. It requires a lot of brainstorming from researching about it to applying. Our experts will make it easy for you to be your buddy in tough times. To make the process easy, you must seek help from a trusted buddy. We will analyze your academic and financial profile and will suggest you the best education loan for Canada. Also, you will get tips about loan repayment.

The time taken by moneylenders varies significantly. Even if two borrowers approach the same lender, the processing time for both of them will vary. The time depends on the amount that you want to secure. Also, it depends on the type of lender; the smaller units will take longer than usual to process the loan application.

You require extra money apart from your education loan. A minimum deposit of CAD 10,000 is required as a Guaranteed Investment Certificate (GIC) in banks like SBI Canada or CIBC.

The amount of up to INR 75 lakhs is available as the unsecured loan option to pursue higher education in Canada. If you are a STEM (Science, Technology, Engineering, Mathematics) student, you can secure the greatest amount.

We are available in :

BangaloreAhmedabadJaipurHyderabadKeralaPuneChandigarhMumbaiGurgaonChennaiKolkataTrivandrumNoidaKochiCalicutKottayamKollamThrissurIndoreUdaipurdisclaimer:logos and other registered trademarks of universities used on this platform are held by their respective owners. Gradding does not claim ownership or association on them, and their use is purely for informational and illustrative purposes.